Trump’s Mexico tariffs risk pricing some Americans out of buying a car – CNBC

“Here’s what you have to remember. Tariff equals tax hike,” said Paul Ingrassia, a Pulitzer Prize-winning automotive journalist now working with the Revs Institute, said on CNBC Friday.

But even vehicles assembled in the U.S. — including those bearing foreign brand names like Toyota, Honda, Mercedes-Benz and Hyundai — would be hit by the tariffs if a resolution isn’t found before they go into effect in less than two weeks. American assembly plants make extensive use of a significant number of Mexican-made parts and components, such as wiring harnesses, that are low value or which have high labor content. About 70% of the wiring harnesses used in the U.S. come from Mexico.

Those auto parts and components bring the total to $99.6 billion, according to U.S. Census Bureau data.

Even at 5%, the added tariff “potentially could scrub the deal, especially for marginal buyers,” said Joe Phillippi, head of AutoTrends Consulting, noting they could add about $1,500 to the cost of a typical Mexican-made Ram 1500 or Chevrolet Silverado pickup. That would jump fivefold if the tariffs aren’t removed by October. With some pickups and other Mexican imports topping $50,000 apiece, the tariffs could add on $10,000 or more — or force manufacturers to swallow a large share of their profit margins.

The average transaction price — what customers actually pay after factoring in options and incentives — will reach a near-record $33,457 for May, LMC Automotive forecast, a 4% year-over-year increase.

“The auto industry gets hammered” if the tariffs are enacted, with the situation getting worse each month as they are increased, Phillippi said.

It is possible that the auto industry may try to absorb some of the added costs, as has been the case with some of the Trump tariffs on imported aluminum and steel, but that would have a harsh impact on an industry facing a weakening market. Sales were off by 2.8% during the first four months of this year and are expected to be down another 2.1% when May numbers are released next week, according to a forecast by LMC Automotive.

Things get particularly complicated on the component side. It has become commonplace since NAFTA went into effect in 1994 for parts to move back across what has become a largely invisible border. Some may cross from Mexico to the U.S. and back again as often as seven times, said Steve Kinkade, a spokesman for Honda.

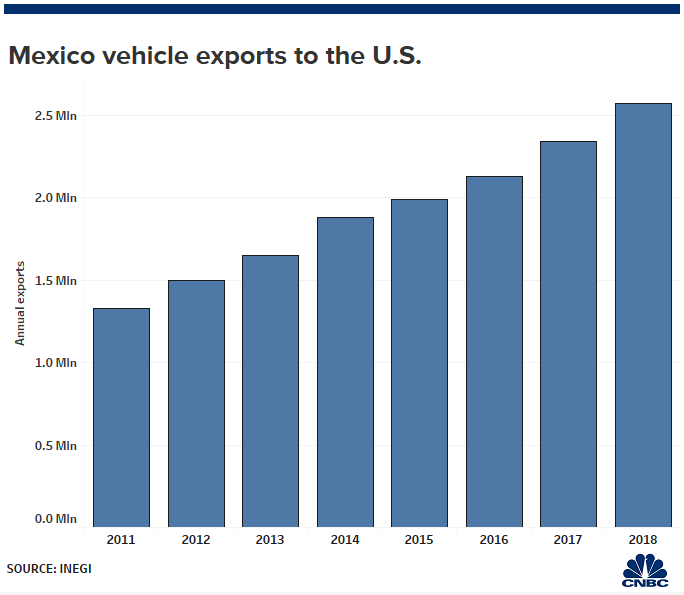

The Japanese automaker imported 107,989 vehicles from Mexico in 2018, a 611% increase since 2011. Its numbers pale when compared to General Motors, which led the industry by importing 666,765 vehicles from Mexico last year, a 109.6% increase since 2011. Next in line was Fiat Chrysler Automobiles, at 504,793 vehicles, a 206.2% increase during the same period, according to INEGI data.