Baby boomers are starting to outgrow their midlife crisis years, and that’s bad news for automakers who want to sell sports cars.

It was a sign of things to come this month when Ford Motor Co. idled its Mustang plant for a week as sales for the year fell 9 percent. Other sports cars have faded at a similar rate, and even stalwarts like the Chevrolet Corvette and most Porsche models are slumping.

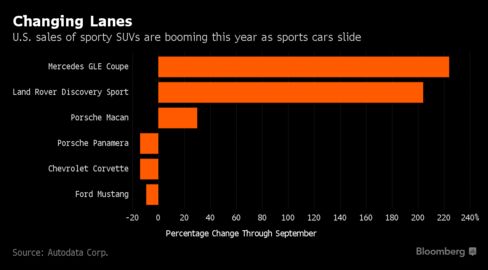

While there are still plenty of buyers who love the passing lane, automakers face a pesky reality. Men born between 1946 and 1964, who buy most sports cars, are cruising past their peak spending years. And as age 70 beckons, folding up like an accordion to get into the front seat of a speedy roadster is hardly the prescription for an aching back. Some are even turning to high-powered versions of luxury sports utility vehicles.

“Boomers are starting to age out of sports cars,” said Eric Noble, president of the CarLab, a consulting firm in Orange, California. “When you get into your 60s, comfort becomes more important. Sports cars are not going away, but the market will get smaller.”

The generational handoff won’t help sports cars much either, Noble said, because there are fewer Generation Xers, or those about 35 to 50 years old. And the boomer children — the millennial generation — aren’t yet earning enough money to buy Mustangs, which start at $24,915, let alone a Corvette Z06 that can sell for more than $100,000, Noble said.

Ford will probably sell more than 100,000 Mustangs this year, but through July about 25 percent have gone to car-rental agencies and other corporate fleets, according to IHS Markit, which tracks vehicle registrations. Even with that many cars going to fleet buyers, sales are off.

This year, about 40 percent of Mustang buyers were baby boomers, down from 50 percent in 2013. The good news is that consumers in their 20s and 30s now make up 22 percent of Mustang buyers, compared with 15 percent three years ago, said Mark Schaller, marketing manager for the Mustang. But the buyer pool has shrunk.

“We are seeing some older boomers move out,” Schaller said. “The Mustang is a life-stage vehicle.”

Corvette, Camaro

Ford isn’t alone in seeing declines. Sales of the Camaro and Corvette are down 11 percent and 14 percent, respectively, this year. Part of Camaro’s drop is because General Motors Co. sells fewer of them to fleet buyers. Retail sales fell only 1 percent.

“I don’t have one reason why it’s down,” said Todd Christensen, marketing manager for the Camaro and Corvette. “Boomers are still buying them, for sure.”

Christensen said Chevy is hoping to spark Corvette sales with the new Grand Sport version of the car, which offers more sporty attributes than the base model, such as high-performance suspension, brakes and tires. It comes with an attractive price, too. The Grand Sport starts at $65,000, which is about $14,000 cheaper than the high-performance Z06 model.

Chevy is also trying to market the Camaro to younger buyers by promoting its smaller, cheaper 2-liter turbo engine in a package with high-performance parts that make the car handle like more expensive versions, Christensen said.

Lifestyle Shift

Porsche may be seeing a similar shift, said Jessica Caldwell, an analyst with Edmunds.com, a car-shopping website. Coupes are no longer seen as cooler than a four-door car or SUV, she said. And with luxury brands like Porsche and Mercedes selling sporty-driving SUVs, the well-heeled can make a more practical purchase and still have some fun behind the wheel.

A car that fits someone’s lifestyle and is still sporty is a better option than a true sports car, she said.

That makes sense when you look at Porsche. This year and in 2015, the brand’s passenger car sales have fallen by 8 percent. At the same time, the Macan SUV has grown by 30 percent this year and is now Porsche’s top seller. Company spokesman Christian Koenig said the sales decline is due to replacement of the 911 and Boxster sports cars, which caused shortages of inventory, and the announcement of a new Panamera coming in January. Porsche believes the new sports cars will once again juice sales, he said.

“We don’t really see a decline,” Koenig said. “Sports car sales in the U.S. has been a rock-solid business.”

Research shows that car buyers, especially 20-somethings, still like sporty cars, according to Noble of the CarLab. They especially favor classics from the 1970s, the golden age of muscle cars. They just can’t afford them yet. And boomers want something comfortable but sporty.

‘Spirited Driving’

That’s why sales of BMW’s M edition and the Mercedes AMG are up, he said. Both are high-horsepower versions of existing models. BMW M-edition sales are up 2 percent this yea. AMG sales are down among pre-existing models. Add in the new SUVs, and the performance line is up about 60 percent to almost 16,000 vehicles this year, said Branden Cote, AMG manager for Mercedes-Benz U.S.

What does a high-performance SUV look like? The AMG GLS63 is a seven-passenger, three-ton vehicle that comes with a 577-horsepower engine and starts at $124,000. It also comes with an Airmatic suspension that the driver can lower to the ground if he wants to zip in and out of a tight turn. That’s the kind of “sports car” that is fueling growth of Mercedes’s AMG line, Cote said.

“Boomers are coming out of pure sports cars, but they’re not willing to sacrifice pure driving,” Cote said. “The idea of a sports SUV was incomprehensible 10 years ago. They’re not giving up spirited driving; they’re going to a different type of sporty driving.”