Earlier this month, the UFC was sold for $4 billion to, of all places, WME-IMG, the talent agency best known for its co-CEO Ari Emanuel, the inspiration for Entourage’s Ari Gold. SportsBusinessJournal had a good piece recently detailing some of the behind-the-scenes negotiating over the deal in which, among other things, it reported that while three media companies were seriously interested, they ultimately felt that the UFC was overvaluing their media rights:

Time Warner was interested in splitting UFC content between Turner Sports and HBO, with iStreamPlanet handling Fight Pass. Time Warner pulled out of negotiations relatively early.

Fox Sports took a strong run at the company, eventually submitting a $3.6 billion bid that the UFC rejected, sources said. Fox executives decided not to increase that bid.

ESPN was interested and received the UFC’s sales deck, but it never submitted a formal offer and dropped out of the process early on.

Ultimately, sources said, each media company was skeptical about the media rights valuation.

Buying the UFC would have represented a serious change in strategy for any of these media companies. Their business models involve paying sports leagues for the rights to broadcast events, not owning them outright.

As SBJ notes, though, the most interesting thing here is that the media networks pulled out of the bidding relatively early on, and that it was a talent agency—backed by private equity—that bought the UFC. (ESPN reported that the other group to submit a $4 billion bid was China Media Capital, a venture capital firm, and also reported that The Blackstone Group, a private equity firm, submitted a bid as well.)

UFC revenue is somewhat difficult to puzzle out, though BloodyElbow made a valiant go at it last year. The UFC told CNN that in 2015 it generated about $600 million in revenue, with pay-per-view being the biggest source. Including $115 million or so from its TV deal with Fox Sports and its $9.99 a month streaming Fight Pass service, and you get to TV revenue making up 50 percent or more of the UFC’s revenue.

Considering the UFC will sign a more lucrative broadcasting deal in a few years, and that it’s easier to scale up television revenue than event revenue, anyone bidding on the UFC was essentially making a bet on how much they think those rights will be worth in the future. WME-IMG has expertise in this field, having negotiated the UFC’s past broadcast deals, but so do Time Warner, Fox Sports, and ESPN, as they’re constantly negotiating sports broadcast contracts. And Fox decided the UFC was ultimately worth just 90 percent of its purchase price, while ESPN and Turner Sports apparently decided the property was so overvalued that they didn’t even enter the bidding. (It’s also possible that they just can’t afford it right now.)

Every sports rights negotiation right now is, among other things, a commentary on the possibility that there is a sports rights bubble. In the last half-decade the value of sports broadcasting rights have exploded, as several competing sports cable channels have launched or strengthened, and DVRs and streaming have left live sports as the last vestige of appointment viewing. But a lot of people—myself included—believe there is a sports rights bubble, seeing developments like ESPN and Fox Sports shedding millions of subscribers and laying off hundreds of employees, the failure of some regional sports networks, and recent difficult rights negotiations as proof that sports networks cannot continue paying more for rights than they actually seem to be worth.

According to SBJ, the UFC told potential buyers that it believes its next broadcast deal will command $400 million annually, increasing UFC’s revenue by 50 percent, presumably in part because their current deal expires at an advantageous time. (It’s up at the end of 2018, and will be the biggest property on the market for a couple of years.) But by Time Warner and ESPN barely getting involved in bidding, and Fox Sports choosing not to up their $3.6 billion bid, is a pretty clear signal that they think that valuation is overblown. And they should know—these are the three companies most likely to be fighting to pay for those rights!

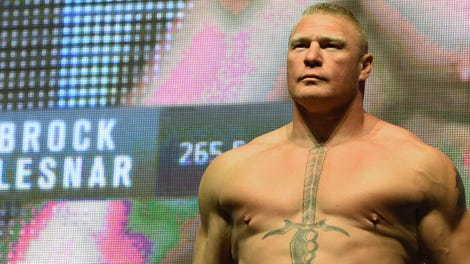

Besides a general cooling of the red-hot sports broadcast rights market and omnipresent cord cutting, the UFC faces a unique challenge in garnering a huge deal: It is an incredibly star-driven sport, and the performance and longevity of those stars is incredibly volatile. Consider the current status of four of the sport’s biggest stars: Jon Jones and Brock Lesnar are facing long layoffs for doping violations, Ronda Rousey’s sharp ascent was halted by a swift Holly Holm kick to the head, and Conor McGregor is feuding with the UFC. We already know UFC pay-per-view viewership is star-dependent, and to a certain extent broadcast viewership is, too, which should make any media company extremely nervous about committing to pay a 300 percent increase on the UFC’s current broadcast deal.

Ultimately, things are still murky enough that you can read into the UFC’s purchase whatever you want. I’m skeptical about the value of sports rights going forward, and therefore see ESPN and Time Warner especially signaling that they agree. Then again, WME-IMG and high-powered private equity and venture capital firms disagree.

Let’s all meet back here in 2026 to find out who is right.

[SBJ]